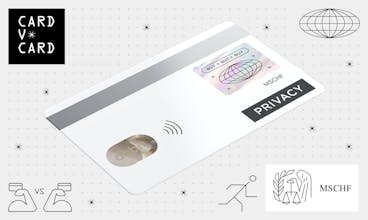

Card V. Card

The world's first competitive multiplayer bank account.

7 followers

The world's first competitive multiplayer bank account.

7 followers

All players’ cards connect to the same account. Money is deposited at random and players have to race to spend it before the others!

You've Got Spam

Makeovr