Lendflow - Credit Decisioning Engine

Your own credit decisioning engine, supercharged

94 followers

Your own credit decisioning engine, supercharged

94 followers

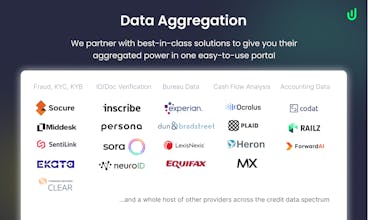

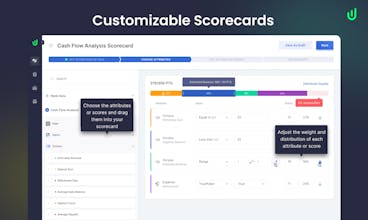

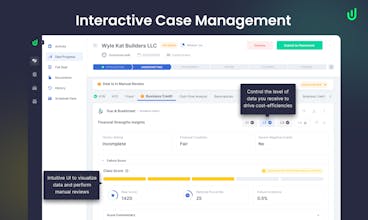

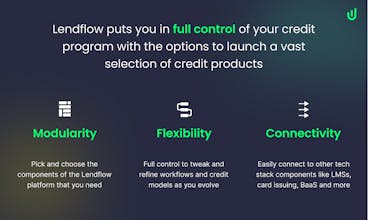

Quickly launch credit products with our open API and flexible decisioning engine that lets you build your own credit workflows and start approving borrowers in minutes.

Lendflow - Credit Decisioning Engine

Growth Everywhere - Mamoon Hamid of VC Firm Social Capital Shares the Secret to Why Sh*t Gets Funded

Lendflow - Credit Decisioning Engine

Lendflow - Credit Decisioning Engine

Lendflow - Credit Decisioning Engine