Subscribe

Sign in

Against scarcity

Share On

Online, goods and services are infinite. What are the costs of making them artificially scarce?

David Phelps is a 2x founder, a cocreator of ecodao and jokedao, and an investor in web3 projects through the angels collective he started, cowfund. Find him on Twitter at @divine_economy.

I.

One reason that it can be hard to appreciate transformative technologies early on is that they are seldom, well, transformative, instead replicating old technologies in hamfisted new forms. Early railroads were powered by horses, only substituting animals for steam when engines were invented for ships. Early cars, in turn, were modeled after railroads and steamships in drawing power from slow-starting steam engines, only shifting to gasoline and consumer popularity many decades later. Similarly, early internet media replicated analog 2D media, reproducing entire scans of NYT front pages for viewers to zoom in on, until CSS enabled dynamic and standardized design across pages on a site. In all cases, these transformative technologies only became such when secondary tech was developed that redefined their potential. In the meantime, they served as a crusty copy of what went before.

So as we softshoe our way to the metaverse, VR, and Web 3.0, it probably shouldn’t be too surprising that our visionary new worlds largely replicate the analog logic of legacy institutions like, say, Sotheby’s, Goldman Sachs, and Planet Earth. What the early web was to a 2D world of media is what the current web is to the 3D world around us. Recreating the physical world online, decentralized universes like Upland serve the noble purpose of democratizing simulated real estate for the average Joes of the world who can now buy map squares of a fake universe representing the location of the New York Stock Exchange for a bargain-basement $23,000 (actual financial opportunities from the stock exchange not included).

I am much more fond of the virtual worlds of Somnium and Decentraland, which allow players to build their own worlds—in short, dumping on us users the mandate to replicate the real world, and to do so in as “decentralized” and often meticulously unimaginative a way as possible. I actually own a parcel of land in Decentraland, the purchase of which my partner may never forgive me, and have quite enjoyed my time there as a decentralized social butterfly, frequenting the decentralized art galleries and patronizing the decentralized casinos and, yes, haggling over prices for plots of decentralized land. But let’s pause there: what does it even mean to say that you can buy decentralized land? How is the economic logic different from buying actual land in a world of physical scarcity?

Again, we find our new technologies replicating old models—in this case, a model of economic scarcity that has little application to the infinity of goods available in a digital world. “Decentralized,” here, evidently refers to p2p purchases, though as in any real estate transaction, there still is an intermediary that takes a fee (here, the NFT platform OpenSea). And to be fair, it also refers to the fact that the 90,000 parcels of land in Decentraland are not subject to any state that would tax landlords nor provide public infrastructure—we might call it, for the sake of simplicity, Libertarianland.

For “decentralized” does not, in any way, refer to users owning the collective protocol or space; it simply means that instead of giving power to a Roblox-like corporation to tax economic productivity in this world, Decentraland has instead given power to the highest bidders. It’s “decentralized” power by taking power from the hands of private entrepreneurs and giving it, instead, to a few thousand rich people.

Like other NFTs, plots of virtual land force a simple question: why do we need scarcity in an online world of infinite abundance? You can argue, of course, that scarcity is a requirement for economic value; if everything were freely available, no money could be made. Scarcity, you might say, is what allows virtual creators anywhere in the world to become rich—but does that also entail a trade-off, that the masses must be poor, bereft of digital goods and services that only go to the highest bidders?

Roblox is an especially interesting counterpoint here because Roblox, nearly 20 years old, actually refuses to replicate the logic of scarcity economics, at least on the level of land. Conceived on the radical premise that virtual land is not a limited resource, it instead gives users the tools to build their own worlds for free. That’s not to say that Roblox doesn’t ultimately follow the logic of rentier capitalism, taking hefty commissions when users monetize their creations on the platform, but that it at least gives all users the tools for world-building. Unlike Decentraland or Somnium, which do incur some significant real-world costs for expanding their single worlds into giant maps coordinating thousands of real-life players, Roblox breaks out multiple worlds for users to minimize cost, and thus is able to make a similar kind of bet as so many successful Southeast Asian countries: by redistributing land to users to give them free means of production, it will incentivize economic development from which the real money is to be made.

And yet, like all virtual worlds, even Roblox ultimately makes money by implementing some form of artificial scarcity on what would and could be a nearly infinite public good; the difference is that Roblox just leaves it to the user to implement this scarcity. If you create a game in Roblox and charge people to play it, the payment itself becomes a price floor, artificially limiting all those who might play. In other words, Roblox can gingerly hand out free land and tools with the safe knowledge that you won’t be incentivized to freely distribute it in turn. It can feel, sometimes, like the internet has given us a utopia of a free and public commons, and that the only thing we know how to do is to stake expensive flags claiming it as our own.

So for the sake of imagination, we might ask a simple question. What would a world look like without scarcity that still rewarded users for their contributions? Or, more simply, what does it mean to monetize truly decentralized, open-source projects? How can we ensure that people contributing to a free, public commons get paid fairly for their work?

II.

While Marx and Keynes both made occasional predictions that industrial automation might eventually emancipate workers to enjoy a post-work world of abundant time and resources, to speak of post-scarcity economics is really to speak of Murray Bookchin. The author of 1971’s Post-Scarcity Anarchism and in some ways the godfather of decentralization, Bookchin anticipated the role computers would play in coordinating supply chains and capital to develop a world where resources would exceed our demand for them: computers would become, he wrote, an “electronic "mind" for coordinating, building and evaluating most of his routine industrial operations.” In this, Bookchin prefigures more recent post-scarcity literature like Aaron Bastani’s Fully Automated Luxury Communism, which argues that automation and solar energy will make post-scarcity the norm not only online but in physical supply chains online. Bookchin’s primary focus on decentralization, however, was not virtual, but ecological.

For Bookchin, post-scarcity economics was no figment of the digital imagination, but rather an attainable goal that could come from harmonious living with the natural world—where we would only take what we need. More significantly, this post-scarcity model would actually mimic the economics of the natural world as well. Nature, Bookchin continually emphasizes, often does a much better job than humans at sustaining productive growth by ensuring that resources are never depleted. We could consider the example of animals that only have single offspring over the course of years in regions with limited natural resources, or we could consider Bookchin’s own case that “stability is a function of variety and diversity: if the environment is simplified and the variety of animal and plant species is reduced, fluctuations in population become marked and tend to get out of control.” For Bookchin, our own insistence of reducing one another and the world to a single, legible variable, money, in turn reduces the richness and complexity of relationships that we might have had with each other and the world as well.

Listen to Bookchin in the mindset of decentralization, the creator economy, communal living, DAOs, and solopreneurism, and the words can sound almost, just-almost, prophetic with their calls to take back our desires from the clutch of commoditized norms:

“Post-scarcity is a ' 'precondition" under capitalism for exorcising the hold of the economy over society, for creating a sufficiency in goods that permits the individual to choose what he or she really needs or wants, in short, for demystifying the economic by exploding it from within — by sheer abundance — as an all-presiding agent over the human condition. Put simply: under capitalism we must try to achieve a level of abundance that renders abundance meaningless and permits us to take possession of ourselves as free people, capable of choosing the lifeways that suit us.”

And:

“I do not claim that all of man's economic activities can be completely decentralized, but the majority can surely be scaled to human and communitarian dimensions. This much is certain: we can shift the center of economic power from national to local scale and from centralized bureaucratic forms to local, popular assemblies.”

Of course, it’s tempting to say that in 2021, the digital world has made Bookchin’s vision possible. While back in the physical world, we take something of a jogger’s pace in racing planetary collapse to a solar-powered future, at least online, we have a full abundance of infinite digital goods that we can create and disseminate freely through digital collectives, through DAOs. With some slight adjustments to our hearing, we might hear Bookchin auguring open-source: by taking the work into our hands, we share it with each other; by sharing the work with each other, we take it into our own hands.

At the same time, however, we might make something of the opposite argument—that virtual economies have unparalleled ability to reduce items and relationships to the legibility of 1s and 0s, creating entire worlds that can be comprehended only as money. It is fair, of course, for transactions, labor-time, and digital production to be monetized—this is, indeed, one of the major promises of distributed ledger technology—but that doesn’t mean there isn’t also something slightly dystopian in seeing all our efforts reduced to financial equations.

Now listen to Bookchin again as he rails against commoditization, the reduction of social status to financial transactions, and the ways that marketplaces inculcate artificial desires, and our prophet of decentralization starts to sound like a cranky critic of NFTs, meme stocks, and virtual reality as a whole:

“The phrase "consumer society" complements the description of the present social order as an "industrial society." Needs are tailored by the mass media to create a public demand for utterly useless commodities. The plundering of the human spirit by the marketplace is paralleled by the plundering of the earth by capital.”

It’s this tension that I’m interested in. It’s the tension between, say, the ways that NFTs allow creators to unite in owning their work and the ways that NFTs peddle status-seeking tokens for overinflated prices—between, if you like, the infinite availability of a given NFT and the complete scarcity of a given NFT, between post-capitalism and hyper-capitalism, between Marxism and maximalism. All are present in crypto discourse today, often indissoluble from one another.

To put that tension more simply: our online worlds should enable a post-scarcity infinitude of freely shared ideas, goods, and protocols, but of course that would only make sense if they were untethered to the actual world where we need money to sleep and eat. Is the web’s artificial replication of scarcity economics an early-stage quirk, or is it a more fundamental reflection of the fact that we can only visit virtual worlds, but ultimately have to live in one of rocks and trees?

I think the answer, in some ways, is: it’s both. The virtual world is a collective technology enabling our ownership of ideas and intellectual property as we’ve never had before, but that also means that it does not, by any means, abolish the ownership of private (intellectual) property either. We need to eat and sleep, yes; but for the moment, we also need—and deserve—to make money for our work. So as long as we live in capitalism in the real world, we’ll be living there online too.

But that doesn’t mean the economics need to be exactly the same.

III.

When I mentioned post-scarcity to Scott Moore recently, he had a simple answer: but what about time?

Indeed, in a post-scarcity landscape, time remains the measure by which we necessarily measure value. Listen to Marx talk about the possibilities of automation in the Grundrisse, as “the general reduction of the necessary labour of society... corresponds to the artistic, scientific etc. development of the individuals in the time set free.” In a world of automated post-scarcity, time is the commodity with the greatest value.

Meanwhile, back in the capitalist world, time is what can give value as well to even the most abundant goods. Take some of the common post-scarcity suggestions for reform: to open up hotel rooms to the homeless once it’s clear they’ll be uninhabited after dusk, for example, or to hand out restaurant food to the hungry once it’s clear the food won’t be consumed. Such proposals suggest that if we want to redistribute abundant goods, we still have to determine that they would have gone to economic waste after a certain time; in other words, it’s still necessary to give rights to companies to determine economic value within that time frame.

Similarly, when post-scarcity novelist Cory Docorow talks about reducing intellectual property rights from 50 years to 1 year, he is proposing another variation of the reforms above—to charge for abundant goods at first and then release them for free later on. At some point, all post-scarcity thinkers have to confront the scarcity of time and draw an artificial line: a good can still be valuable, perhaps even more valuable, within a certain time, but past that, we might make it openly available. It is, in some sense, the opposite of a freemium model.

IV.

To understand how a scarcity-of-time model might work in practice when applied to infinite digital goods, we might return to Roblox and Decentraland. Let’s imagine our own universe here, one that’s truly decentralized with virtual land for all. We’ll call it Freelandia.

Here in Freelandia, you’ll have free access to whatever tools you need to create and sell digital goods. Let’s say you want to build virtual car parts that others can monetize however they like. You might write the code for, say, a digital tire, but because you believe in the free abundance of digital goods, you release it open-source with a provision that anyone who makes money from it will give you some commission proportionate to its share of the overall code. Now let’s say that I come along as a virtual car designer who uses your tire code to build a car. Nevertheless, since I also don’t want to artificially limit the supply of digital goods, I likewise set a provision to receive a commission from anyone who monetizes off of it. And so on.

We can, in theory, make money. If a racecar driver uses the car to win a competition in Freelandia, for example, you and I should each receive some share of the profits based on the open-source code we wrote. But there is no way around scarcity in monetizing. Competitions themselves are a form of scarcity, after all: only one driver can win, and one driver’s win is another loss. In fact, that’s why our protocol to support a productive economy of drivers turns out to be a costly tax: since our driver presumably has to give up a share of profits to us if they win but incur full losses if they lose, their overall expected returns are also negative, and they may not want to race at all. We may or may not want to rethink our original strategy for monetization. Yet even if we stick to the strategy above, we’ll still face a pesky fact: we might have done better by also selling off our racecar in limited editions to high bidders who would pay not only for the good, but the right to have the good before everyone else.

In other words, open-source can stay open until the time comes to sell a finished product whose value comes from its own scarcity. Post-scarcity is hard!

But assuming the scarce resource is time, we might still have the option to sell off our good to the highest bidder while eventually releasing it to the masses. For example, we might hold an auction every 24 hours for a racecar. Those willing to pay the most would get it first and could monetize it sooner; eventually, the high bidders would taper off, and the racecar would become more freely available. Each day, we could even double the racecars available to accelerate access.

Incredibly, this option turns out to maximize our own profit. For we’re just working our way down the demand curve.

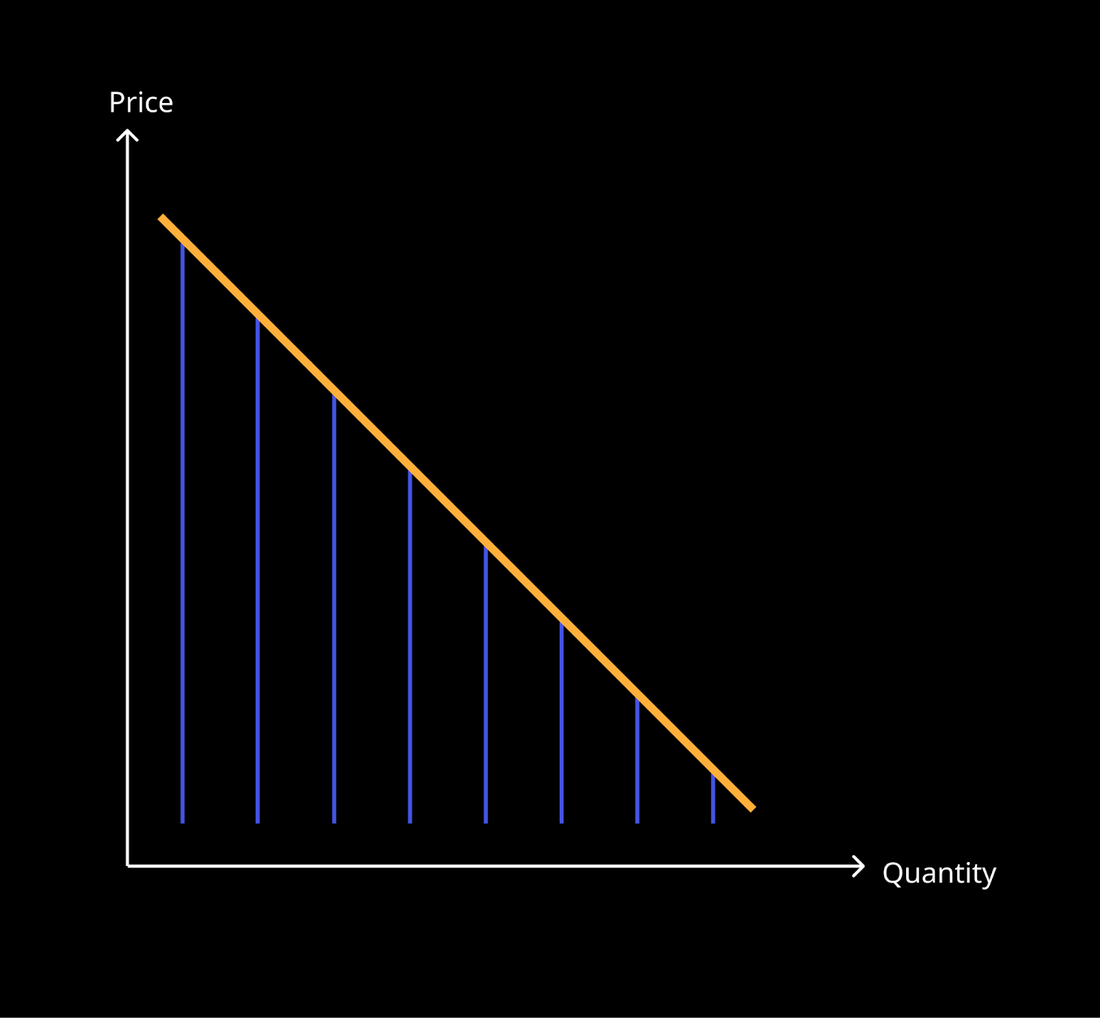

In “NFT Economics,” I argued that the lack of a supply curve for digital goods means that the perception of scarcity is required to drive demand. The perception of scarcity here would come from restricting the time of release. By only releasing digital goods in limited batches one day at a time, sellers could often capture the consumer surplus that they typically can’t for physical goods. Starting with the leftmost purple line above, they would charge the most to the buyer willing to make the most, and gradually, over many days, they would open up greater and greater quantities to those willing to pay less and less. Some calculations would be needed to determine the optimal window for the artificial delay—wait 24 hours before restarting the auction? 48 hours? If the window were too short, it would compromise the perception of scarcity, and if it were too long, it would compromise total profits.

But the bigger point here is that digital economies give creators and sellers far more power in marketplaces than they might otherwise have. Rather than optimize profit at the intersection of the supply and demand curves, as manufacturing firms might do, online creators can effectively charge their customers as much as they’re willing to pay. That’s the consequence of losing the supply curve—and taking advantage of the ways that time’s scarcity gives value to all things.

V.

“Once we recognize that the state is not just a spender but an investor and risk taker, it becomes only sensible to ensure that policy leads to the socialization not only of risks but also of rewards.”

— Mariana Mazzucato, The Value of Everything

The larger point here, though, is simply that digital economies are setting themselves up to be unsustainable for everyone as long as participants adopt a scarcity framework to maximize individual gain.

Ethereum, for example, was lauded by the cryptosphere for implementing a mechanism that would make the currency deflationary by burning tokens. By making Eth scarce, its value can only go up! But historically, what deflationary currency has ever powered a successful economy? Economies must, of course, grow, presumably with greater numbers of users and transactions over time—so rather than mimic that economy’s growth, a deflationary currency can only hinder it. Imagine, for example, taking out a loan with a deflationary currency. With inflationary currencies, our installments get cheaper and cheaper as the currency grows over time: 30 years from now, the real value of a $1500 monthly mortgage will likely be worth much less, perhaps $750 or $500 in today’s terms. With a deflationary currency, the opposite will happen. By the end of the term, that $1500 is worth the equivalent of $3000 or $6000 or $10,000 today. Nobody with a calculator would ever take out a long-term loan to spur economic development.

Or we might return to my little plot of land in Decentraland, which I made sure to purchase next to a virtual road. While teleportation is technically possible in Decentraland, walking is standard, and I knew that a property next to a road could bring visitors into my gallery while a plot away from the road could get built up by neighbors on all sides—making my land fairly inaccessible. There are two points to be made about the digital commons in my decision. First, I knew I was dependent on a public good, a virtual road, to give value to my private land. And second, I knew that my neighbors would have no incentive to contribute to public goods that would help my investment but would be incentivized to prioritize their investments that would hurt my own. This, too, is the product of a scarcity framework.

With Decentraland, we see the limits of a fully privatized virtual world; it is telling, for example, that Decentraland itself programmed in roads with some understanding that state infrastructure and public commons would be necessary to give value to private investment. And it is telling that many plots of land in Decentraland will likely be worth much less from the competitive overdevelopment of neighbors than if a protocol existed for inhabitants to create public goods to support one another. That is not to say that Decentraland won’t be a success, in some way—it already is—but simply that there could be far greater value if users weren’t desperate to horde scarce resources from one another and could instead contribute to the ongoing development and expansion of a shared, multiplayer vision.

Earlier I mentioned Scott Moore, the cofounder of Gitcoin, a project to develop digital public goods through grants. Rather than crowdfund creators’ projects directly, Gitcoin allows the public to crowdfund projects for developers to build, with the provision that the developers’ code for these projects will remain open-source. Essentially, Gitcoin offers another variation on capturing consumer surplus in the demand curve above: those who want code the most will pay for its creation to get first access, even though the code will become available to anyone who wants it. Code, here, is a public good, like a virtual road, and Gitcoin itself is a public commons. It may ultimately produce far more value for private companies and projects than the coders themselves will ever see, and it will be interesting to see if Gitcoin and similar projects evolve to let the public commons itself take a share of profits in the projects that they undergird.

In the meantime, though, Gitcoin offers a tentative answer for how to define economic value in a digital world of post-scarcity. That answer is a public commons. The scarce resource is a worker’s time, but if a public commons can fund that, everyone can, in theory, share in the rewards.

With special thanks to Scott Moore and Lila Shroff.

–

This article originally appeared on Three quarks – deep dives into crypto and web3: what does the past of tech, culture, and economics tell us about their future?

Comments (17)

Super Technologies@super_technologies1

Scarcity is an interesting concept. It's not just about having a finite number of resources, it's also about having a finite number of use-cases for those recources so in this way, scarcity is a double-edged sword: it allows us to limit the supply of something in order to protect against overuse or waste, but it also makes us focus on finding ways to make more efficient use of what we have.

Share

Online goods and services are infinite. What are the costs of making them artificially scarce? The costs of making online subway surfers goods and services artificially scarce can vary depending on the type of online good or service.

@sewn_shara red ball 4 also offers online services for players.

I recommend you to try fireboy and watergirl. It's a very nice game that will help you relax and de-stress.

Bu hayal sohbet siteleri, insanların kendi hayal dünyalarını paylaşmalarına, yeni fikirler keşfetmelerine ve ortak yaratıcılıklarıyla benzersiz bir topluluk oluşturmalarına olanak tanır. İster fantastik bir dünyada ejderhalarla dolu bir macera, ister bilim kurgu evreninde uzak galaksilere yapılan bir yolculuk olsun, herkes kendi hayallerini paylaşma ve diğerleriyle etkileşimde bulunma şansını bulur.Sohbet

Chat

Sohbet odaları

Sohbet siteleri

More stories

Mathew Hardy · How To · 3 min read

How to Detect AI Content with Keystroke Tracking

Sanjana Friedman · Opinions · 9 min read

The Case for Supabase

Vaibhav Gupta · Opinions · 10 min read

3.5 Years, 12 Hard Pivots, Still Not Dead

Kyle Corbitt · How To · 5 min read

A Founder’s Guide to AI Fine-Tuning

Chris Bakke · How To · 6 min read

A Better Way to Get Your First 10 B2B Customers