Subscribe

Sign in

Has venture lost its soul?

Share On

A book review of The Power Law

Evan Armstrong is an investor, founder, and adviser. He's a lead writer at Every, where he writes the Napkin Math, a publication focused on business breakdowns, by the numbers. Find him on Twitter: @itsurboyevan.

The base of the Eiffel Tower is a strange place to have a panic attack. However, for 20-100 tourists a year, that is exactly what happens with “Paris Syndrome.” People afflicted with the malady suffer from a wide variety of symptoms all under the banner of mental distress. Paris’s majesty has been built up to such a degree that the real thing can’t/won’t match the baguette-filled paradise they hoped for and tourists’ brains break.

Nerds (like me) visiting Silicon Valley for the first time experience similar psychological distress. On the outside looking in, I imagined SF as this cyberpunk epicenter. A land of hackers building technology, innovating under neon lights. Instead, I found a lot of entitled millionaires with “We Believe In Science” signs in their front yards. The only building people were interested in was the building of wealth. All of this is totally fine! Just very different then what I had thought it would be.

And if you think about it, it is kind of weird that Silicon Valley exists at all, regardless of its lack of Bladerunner aesthetic. There are a lot of other places that probably should’ve been the center of the tech universe. Boston had better universities and more government contracts. New York was and is the financial center of the world. The oft-cited catalyst of hippie culture existed in places besides Northern California.

The question of Silicon Valley’s existence borders upon the spiritual. It is a region that has birthed nearly every major technology development of the last 40 years. If you believe, as I do, that technology must jump radically forward for the human race to survive, then learning what powered the Valley’s output is worth serious study.

The answer to the question, unfortunately, appears to be rich assholes.

This story was originally published on Every.to

Comments (12)

Moshe Howell@moshehowell

This is a hard conclusion to draw, because there's still a lot of money in venture capital. But it's also true that the people who control it have a pretty strange idea of what they're supposed to do with that money. VCs used to be able to choose where their money went: Visit this https://www.musicianlink.com/content/admin%3B-please-enable-australia-drop-down-registration-form.-thanks site to know more about venture.They could invest in startups without worrying about whether those startups would fail or succeed; if you wanted an exit from your investment sooner rather than later you could sell them on an IPO (or even just

Share

It's a phenomenal book and your review is spot on @evan_armstrong.

It's interesting to consider the power law in terms of Mauboisson's "success equation" and think how much is luck and how much is skill. For instance vintage years 92-98 clearly benefited from some luck (the dot-com bubble), and we'll likely see that same thing is true for vintage years 16-21. But then what will the reversion to the mean look like? It likely looks like the 50%-ile, which has on average underperformed the S&P...

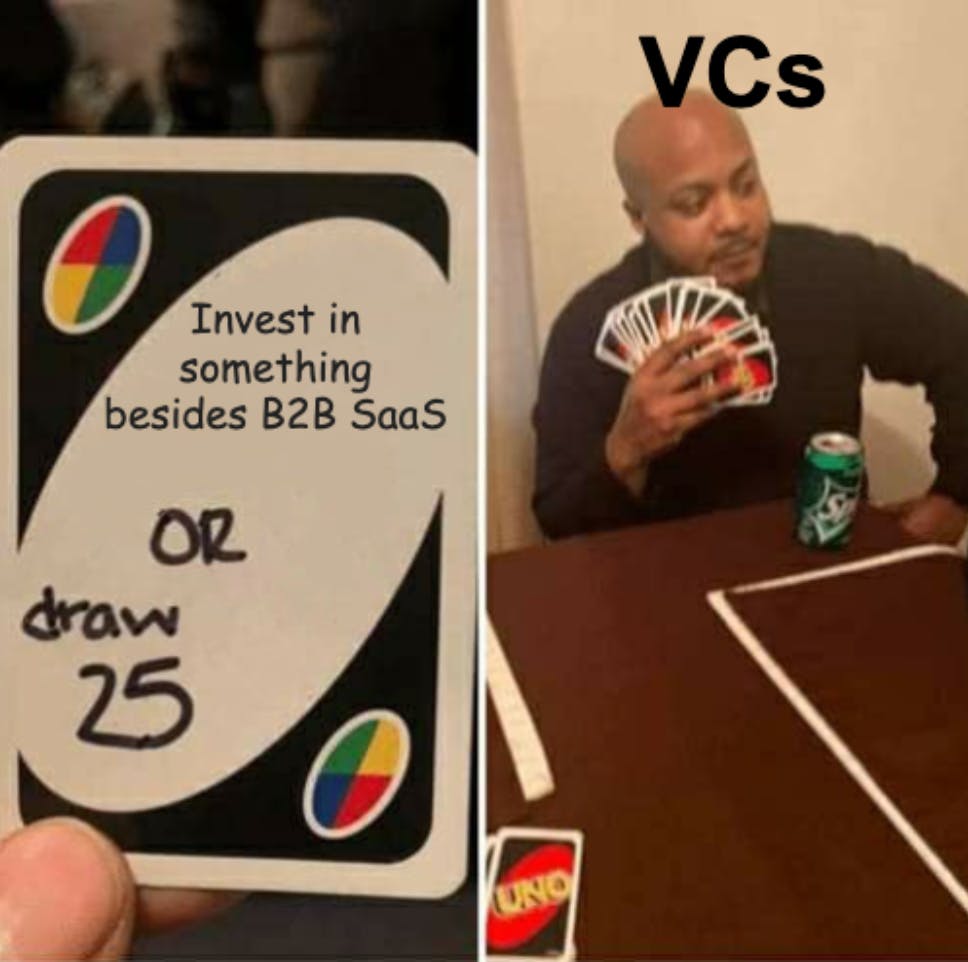

At the same time, the increasing homogeneity in investing (i.e., B2B SaaS, or as Marc Andreesen says "software is eating the world") will likely lead to decreasing variance in performance--UNLESS we invest in moonshots that will be able to capture the Power Law in action!

ParagraphAI - Write better, faster

Has venture lost its soul? This is a question that many in the industry are asking, as the landscape has shifted in recent years. Once a hotbed of innovation and creativity, venture capital has become increasingly risk-averse, focused on short-term gains instead of long-term success. This has led to a decline in new and innovative companies being funded, as investors are more likely to put their money into safe bets.

There are a number of factors that have contributed to this change in the venture capital industry. The dot-com crash of the early 2000s led to a loss of confidence in new and unproven companies, and the financial crisis of 2008 made investors even more risk-averse. In addition, the rise of the unicorn startups – companies that achieved billion-dollar valuations – has made investors more focused on quick returns.

The result of all this is that the venture capital industry has lost some of its luster.

Written with ParagraphAI. - We're trending and just launched on PH homepage today!

Loved this - thanks for sharing. Excited to hear how you think writing plays a role in the future of VC.

More stories

Sanjana Friedman · News · 10 min read

How to Ace a Product Demo

Lenny Rachitsky · How To · 15 min read

The ultimate guide to willingness-to-pay

Mathew Hardy · How To · 3 min read

How to Detect AI Content with Keystroke Tracking

Sanjana Friedman · Opinions · 9 min read

The Case for Supabase

Vaibhav Gupta · Opinions · 10 min read

3.5 Years, 12 Hard Pivots, Still Not Dead