Direct to Consumer has been the “it girl” strategy for brands for the last decade. Selling directly to consumers instead of through retailers has enabled brands to increase margins, gain better insights on customers, control their image, and more.

That’s all great (mostly)… for the brands.

Jeremy Cai’s parents started a manufacturing business before he was born, so he was familiar with how manufacturers fit into the buying & selling equation. It usually looks something like this:

Let’s say a scarf manufacturer spends $10 on raw labor or materials (in reality, these numbers would be much larger). Their next step is to sell what they make to a retailer or brand for about $12. That retailer typically makes a 5-10x margin on the sale, meaning it will sell the item to you, the customer for $60 to $120. That’s $108 tacked on to the price as the fabric moved from finished good to your neck, even though the end product — your scarf — was the same when the manufacturer handed it over for $12.

That $108 is where Jeremy saw opportunity — higher margins for the manufacturer, lower costs for you. Enter, Italic.

I spoke to Jeremy, Italic founder and CEO, not long after Italic announced its $26.9M Series B fundraise.

Doing what you know

“Do what you know” is oft provided advice to new entrepreneurs undecided on where to start. Jeremy is a repeat founder. You may know him from his first (and recently flourishing) company, the hiring platform called Fountain (formerly Onboarding IQ). The aforementioned mantra was something that stuck with Jeremy throughout his time running Fountain.

About four years into the startup, he started thinking about what would get him excited again.

“My parents started a manufacturing company 30-40 years ago. You never think you’ll do what your parents do…” he started.

This was around the same time a second crop of direct-to-consumer darlings were having their moment, Jeremy explained. You can identify the first crop by Warby Parker and Bonobos, and the second with Glossier and Away.

“Those brands bypassed the retailer, but the products were equivalent to the brands. Once Google and Facebook became saturated, they became the new retailers. If you talked to manufacturers during this time, they would tell you that it doesn’t matter who the buyer is — the retailer or the D2C brands — they’re all the same. ‘I make my small margin and produce high volume for them, and they get 5-10x what I sold it to them for’ they would say.”

Bringing manufacturers online

Jeremy had also been taking note of startups tackling legacy experiences at the time: Uber on cab-hailing and payments, Airbnb on travel stays, etc. So he started thinking:

“What if we were able to offer the same quality and experience as a brand or a retailer, but adopt a managed marketplace mentality, providing the technology and infrastructure to the manufacturers to sell their goods directly to customers?”

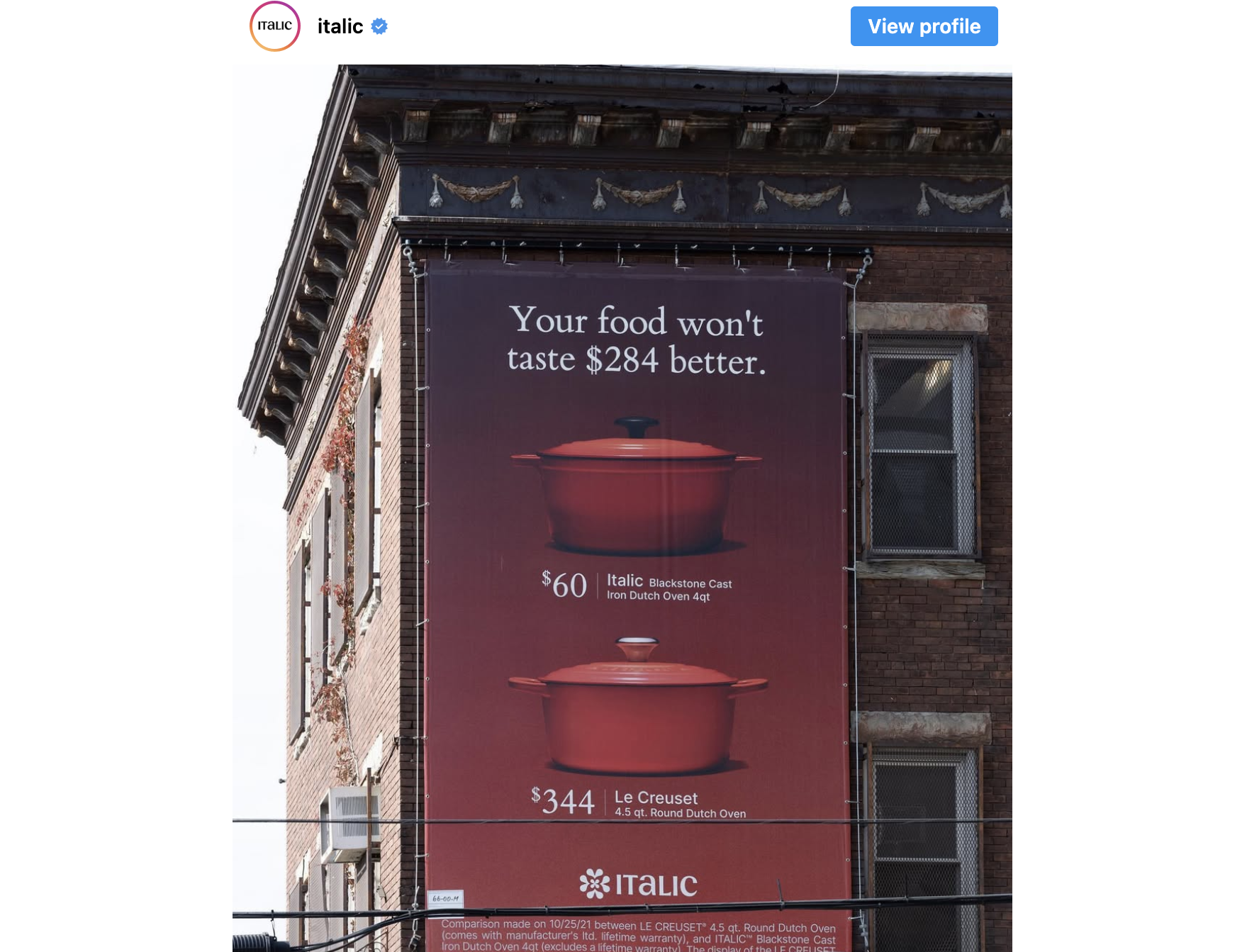

In Italic, manufacturers are merchants — the companies that produce goods for top brands, from Burberry to Le Crueset. These merchants offer the same products that they sell to brands and retailers, but with 50-80% lower prices. The savings comes from cutting out the middleman. Italic doesn’t do much of what the retailers or brands are spending their money on — inventory or product development. Instead, it’s providing merchants the technology they need to go online and sell to consumers.

When I asked Jeremy if the Direct to Consumer movement helped paved the way for Italic, he explained that D2C helped pave the way for people to buy brands online and still have a good experience. In most other ways though, D2C doesn’t matter. Those companies are still just brands.

“Our job has been figuring out how to digitize the supply chain and bring these manufacturers online. We work with about 70 manufacturers or so. 5-10 are publicly listed companies now and the majority of them don’t have websites. That’s how antiquated this industry is. If they’re familiar with eCommerce that’s great; that might make it easier to get them online. But we’ve brought many offline manufacturers online as well.”

Meanwhile, the consumer doesn’t have to know about any of this if they don’t want to.

On B2B2C acquisition: A chicken & egg dilemma

Put all so simply, it sounds like an easy sell for manufacturers: sign up with Italic and double or triple your profit margins. Of course, I had an inkling it was much harder than it seemed.

“It was so hard,” laughed Jeremy.

Manufacturers are often generational, some 3rd or 4th generation-led, he explained. Most make money the same way: They take a deposit from a purchase order, which they put towards material, rents, equipment, labor, etc., and claim the additional profit after the goods are produced (for example, a 20% margin on the production run).

"They’ve always gotten paid soon, or at least after the production run. In our case, we’re saying ‘You’re going to make a run, pay for it, and we’ll pay you when we sell it.’ It does take a leap of faith on their side. The first year, Polo (Sourcing Manager) and I visited over 150 manufacturers in Asia, Europe, and the US. Only two said yes — a leather goods manufacturer and a cashmere scarf manufacturer. They’ve stayed with us this whole time.”

In addition to upfront cost, getting manufacturers on board was also challenging out the gate with a small number of customers. It was a classic chicken and egg problem.

“Italic is a business that benefits from scale. Unit costs are [cheaper] with more volume. The more volume we have, the more leverage we have to pitch and onboard manufacturers. The more manufacturers we get, the more products we can offer. And the more products we have, the more consumers we can acquire. That’s why I think [acquisition] has gotten easier, besides just getting better at the pitch and the technology getting easier to use. A lot of those 150 manufacturers that we first pitched have now become merchants, but it took a long time.”

The lesson here? On the manufacturing side, Italic has made its progress with a simple strategy — “brute force” and hitting the pavement. And on the consumer side…

Finding product-market fit

“I always feel like it’s a moving target,” Jeremy said when I asked him about product-market fit. “Sometimes it feels like you have it and sometimes it's like “Do I really have it?” A lot of people try to put definitions on it, but the longer I work in tech, the more I feel like you can find product-market fit but then lose just as quickly.”

I asked Jeremy about product-market fit with myself in mind. It feels like I am likely a persona in Italic’s target audience — but brands are undoubtedly persuasive. After all, I’m a Warby Parker, Casper, and Away customer. I scope out the runway sections of TJ Maxx (or TK Maxx in the UK). So why is Italic’s offering so enticing to me?

There are a lot of reasons why I, or anyone, might choose a brand over a generic label: status, design, and quality are the main ones. Italic’s shot at making a serious dent in the market seems to rely mostly on competing against the last two, i.e. selling products of comparative quality and design, but with a better price. There’s also the fact that in modern consumerism, we expect our brands to serve a larger purpose. Italic’s model of championing manufacturers has that going for it too.

The challenge comes in explaining all of it.

“Consumers are more educated today and have resources. They take meaningful time to learn about how Italic is different, but it takes one level of extra effort to explain that you can buy from the manufacturer, and why it’s cheaper,” Jeremy noted on challenges. “We have a lot of tailwinds for us. Private label growth has been the fastest-growing segment of new branded product in the last decade, consumers are more willing to buy products from brands they’ve never heard of, and marketplaces online have exploded in popularity.”

The biggest challenge of all, he shared, is education.

“My opinion so far is that the only way to solve for that is organically and with referrals.”

On marketing something that’s hard to explain

The challenge of educating the public on how Italic works hasn’t stopped the startup from experimenting with advertising. Although Jeremy notes Italic has done very little advertising thus far, its comparative marketing approach has definitely caught some attention.

“Comparison is the easiest way we have found to have our customers understand what we offer. It’s an advertisement, it’s very fast to explain.” And in regards to those brands that might not love the approach? “Our job isn’t to play it safe and be friends with everyone, obviously,” he said. “With the model itself, you’re inevitably going to ruffle a couple feathers here and there but ultimately, if it's in service of the customer, we’ll do the right thing.”

As for Italic’s referral strategy, Jeremy said they haven’t pushed it much, but attribution data backs up his theory. Post-purchase attribution (i.e. “how did you hear about us” type surveys) continually reveal friends and family as the number source of purchases, and last-touch attribution (i.e. the last touchpoint a user had before they converted) credits organic traffic. In other words, the shopper went straight to Italic to make a purchase (“for a long time we thought that was a bug but we’ve audited it”).

Jeremy notes that referral attribution will likely shift as the startup leans into more aggressive marketing, but so far it’s been the moat of the business.

“Our customers are the best ambassadors and educators because it is admittedly hard to explain the whole thing.”

On changing pricing models

Italic reached a tipping point last year. Since its launch, the marketplace had relied on a membership (pay-to-shop) model to make money while it took a negative margin on products to get more manufacturers on board.

“Going back to economies of scale, as volume grew, we saw a lot of benefits in the unit costs and we started to turn green on those products while maintaining the same prices,” Jeremy explained. So Italic opened up its site to allow anyone to purchase products, enabling more people to try Italic first without having to commit to a membership. Memberships remain but they’re offered as an optional upgrade.

“After a lot of customer interviews and looking at the data, we decided on three ways we’ll make money: Membership fees, product sale commissions (like other marketplaces), and service fees for things like fulfillment, payment processing, and creative services. We want to be the most competitive in the market — the highest quality for the most competitive price to a consumer.”

On progress

Between tailwinds and hitting the pavement, the Italic team has gained enough momentum to look optimistically past its cold start problem.

“We’ve built this playbook and flywheel that are really powerful and improving. On the playbook side, we’re able to launch products with velocity, at a price point that is frankly really hard to achieve with both legacy companies and newcomers. Over the holiday season, we increased our product assortment by 50%, and this year we’ll more than double it. On the flywheel, we plan to acquire more customers, use that to acquire more merchants, and bring more products online.

We’re starting to reap the benefits of a lot of effort that took a long time. I’m really excited about taking more and more of our customers’ lifestyle shopping habits and putting the Italic spin on them.”