Subscribe

Sign in

Use-cases of NFTs: a framework

Share On

NFTs are the great digital status symbols—which is a way to say that they have little utility or use-value. But what will the world look like when they do?

David Phelps is a 2x founder, a cocreator of ecodao and jokedao, and an investor in web3 projects through the angels collective he started, cowfund. Find him on Twitter at @divine_economy.

This is the first in a multipart series on the use-cases of NFTs; as such, it aims to provide a framework for evaluating when NFTs can actually be valuable and useful in our lives. In part two, we actually dive into some particular use-cases with real-world applications.

The Creature Economy

Spend too much time with NFTs, and it starts to become clear that in some way or another, the unique properties of a given NFT inevitably reflect our own unique properties as individual creatures. The comparison can only go so far, of course: no, humans are not money, and living organisms are not currency. But just as our own social worth is so often determined by a few slight variations in code, there’s good reason to think that NFTs are often the software version of biological organisms.

Lest this sound like the 3am ramblings of a philosophy student who has just made the dual discovery of edibles and Gottfried Leibniz, let’s consider the preponderance of phenotyping in popular NFT projects. The computer code behind Cryptopunks, Cryptokitties, Bored Apes, and Mooncats playfully simulates genetic code, generating unique permutations of physical traits that combine to form a commoditized image of, well, some weird shit that might look like a yokel monkey who’s seen things in the platoon, or Chester Cheetah as an undercover cop. It’s notable that in the most popular projects, this genetic code extends to clothing, expressions, and personality traits, as if our own character—and characterization—were algorithmically determined from a few limited options. Gather enough of those traits together and you have a personality; gather enough personalities together, and you have a very valuable collection to sell on OpenSea.

As in OpenSea, as in life: it’s often the slightest variations between us that can give us vastly different value on the marketplace depending on the buyer’s social sense of beauty. We are assuming, of course, that character traits can be not only assigned genetically but visualized in pixels, a convenient assumption to make when NFTs sell for millions as digital art.

But what if NFTs could represent lifeforms and their interactions in other ways besides the visual? It’s increasingly clear that the next wave of NFTs will be dynamic, capable of growing, propagating, and working—that is, NFTs will increasingly resemble biological life forms whose interrelationship of code and environment can produce thousands of possible lives, possible stories. Zed Run, for example, gives a glimpse of this future with NFT horses that can be bred and raced. I personally love Zed Run’s vision of gameplay-as-investment (race, breed, or hodl your horses), as well as the fact that no actual horses are made to risk their lives for human gain. At the same time, I find the determinants of value for these new NFTs only slightly more depressing than those of the old ones: that is, if we’re not judging each other for what we look like, then we’re judging each other for our genetic superiority in how fast we can run, how many races we can win, and how many winners we can breed. There’s a reason that NFTs are art for those of us who love numbers.

In any case, this vision of NFTs-as-biology seems clear enough as a template for the future. We’ll own, franchise, and play as our NFTs as the new Neopets or Pokemon—but this time with added opportunities for growth, monetization, and social interaction with the real world.

But this is only one option for NFTs, only one way that they might reflect our own unique identifiers as humans. So we might ask ourselves: what are the options for NFTs besides collectibles? And how could they transform our world in ways that, well, might actually be good?

What follows is intended as a framework to understand how the properties of NFTs might make them particularly useful—or useless—in our own daily lives. NFTs are special, I believe, for two reasons: they correlate to our own unique traits as biological organisms, and they allow us to turn nearly any good into an investment with resale value. To understand those points, it is necessary first to understand just why NFTs are truly non-fungible—and why they’re truly tokens. Once we’ve understood their properties, we can see why they offer a whole new way of reading very traditional meanings and values into the world around us.

Or, if you prefer: once we understand the unique properties of NFTs, we can start to understand just why they might transform the world into a place where nearly everything is an investment.

Are Non-Fungible Tokens tokens? And are they fungible?

Recently, Gabriel Leydon forecast that NFTs have only begun with collectibles and gaming—presumably the use cases with the highest value-to-labor ratios—but could transform nearly every industry. This game, how could my industry use NFTs?, is in many ways a subset of the larger game that companies have started to play, How could my industry use Distributed Ledger Technology? It might be helpful to define some rules for the game in order to answer the bigger questions here. That is: when should something be a non-fungible token? And when shouldn’t it?

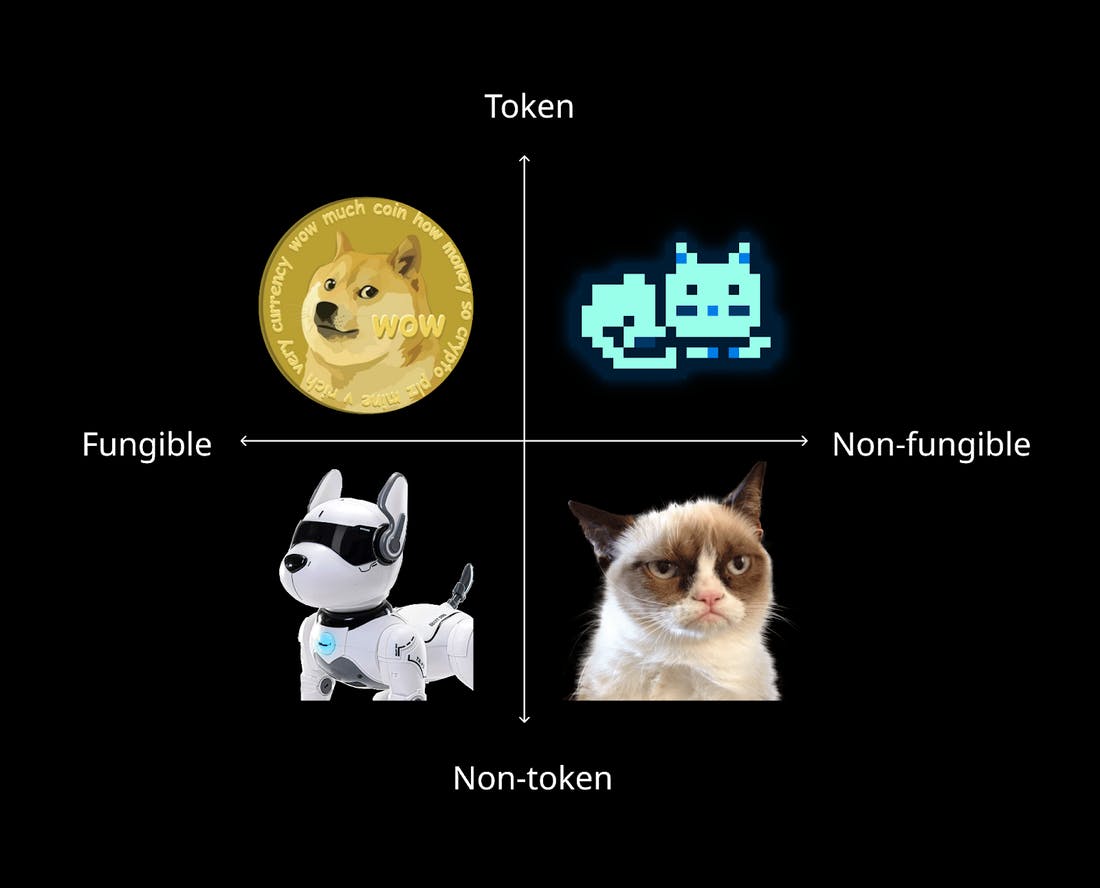

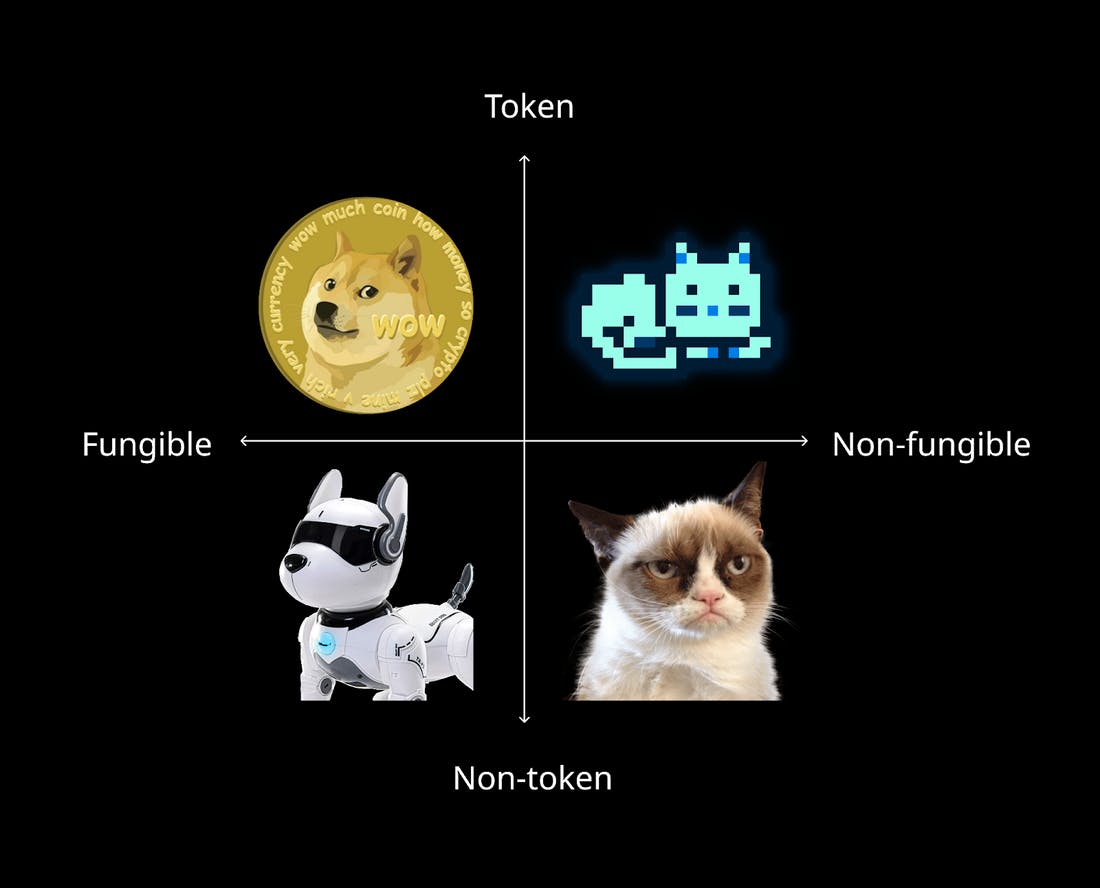

We’ll use what we might call a Doge-Catz-Matrix.

We figured out cryptocurrency. The Doge-Catz-Matrix.

In the lower right lie actual living things like, say, a Grumpy Cat: they are non-fungible because they exist in editions-of-one, and they’re non-tokens because, well, you shouldn’t treat living things as currencies.

In the lower-left lie toys, or really any mass-reproducible object. Imagine human inventions from early bronze-age cutlery, through to the 20th century’s golden age of mass manufacturing, and you have fungible non-tokens. Often, these may be tools for eating or sleeping or studying, but humans being humans, these are often talismanic options for ceremonies and rituals played within a set of rules—think everything chess pieces to rosaries.

In the upper left, we have fungible tokens, which humans had to invent to buy and sell the fungible non-tokens. These are, of course, trading currencies, including the US Dollar and Dogecoin, used as mediums of exchange.

And finally, in the upper right of the Doge-Catz-Matrix, we get to non-fungible tokens, like Cryptopunks, Bored Apes, and, above, Mooncats. On the surface, non-fungible tokens here actually look a lot like their opposite, the fungible non-tokens, i.e. fun toys for people to collect as items for their sentimental value. Indeed, the NFT hype of March 2021 produced a variety of questions about whether NFTs were truly non-fungible when digital goods can be infinitely produced; answers analogized NFTs to signed copies of a book, to edition-of-one photographs that were themselves mechanical reproductions, and to Duchamp’s urinal that skyrocketed in value when he rendered it useless by placing it in a gallery. The answer, in other words, was authorial context.

But the much harder question is arguably why NFTs are considered tokens when users can use them as tools like skins, weapons, and intellectual property. Doesn’t that make them non-tokens?

One way to approach the question is to think of non-digital NFTs like apartments, artworks, sneakers, and baseball cards, all of which have unique value. But that’s also the point. Because not only the NFT but the value of the NFT is completely unique, an NFT will be worth as much as the top buyer in the market is willing to pay for it—which means that unlike fungible non-tokens like mass-manufactured tokens, NFTs will have a value that’s greater than what 99% of buyers think they’re worth. That, in turn, makes them purchasable largely as investments, just as the fact that they’re investments drives their price even higher. It’s a virtuous cycle.

Seeing as a Stat

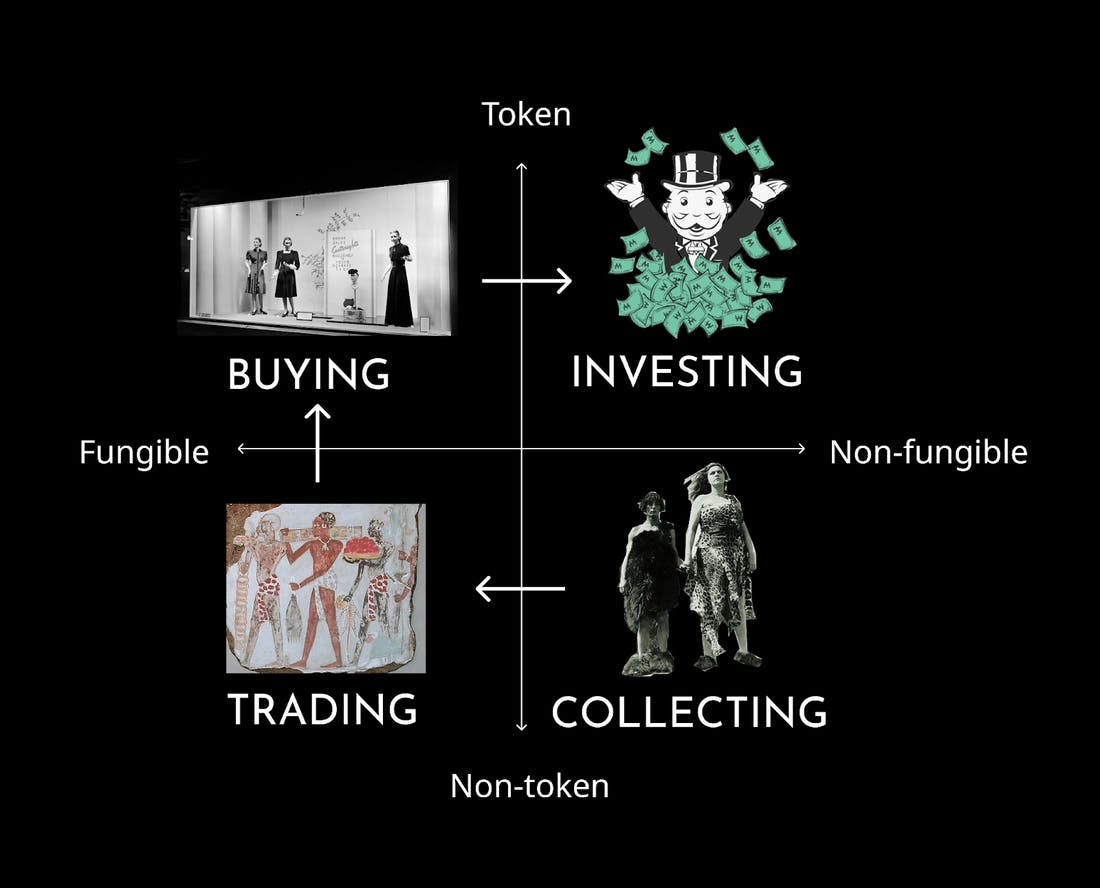

And now we can revisit our matrix to see that it’s also giving us a whole history of the ways that humans have interacted economically with the world.

From the Caveman to the Monopoly Man: the evolution of economic behavior.

Again, we can work our way clockwise from the lower right, starting with collectors. For those who live self-sufficient lives, free from economics, the earth is basically a mass of non-fungible non-tokens to be harvested and gathered. Sensitive to the individualities of the living world around us, collectors know how to differentiate a good mushroom from the bad, a ripe lemon from one that could wait a week to fully brighten.

Traders, meanwhile, barter one good for another, but the goods become indissociable. If we trade four barrels of oil for fifteen bags of soybeans, we are not concerned with the individual distinctions between the drops of oil or shells of the beans beyond a minimum threshold of quality—if we were, we could no longer standardize them in units. One 7-ounce bronze age ring is equivalent to another 7-ounce bronze age ring for the purposes of trading, even if their proportions don’t quite match. While typically tethered in materiality, these goods are the first steps towards humans creating virtual worlds in which we inscribe and read meaning onto objects that is entirely of our own invention.

As buyers, in the upper left, we’re no longer even concerned with the utility of the item at all that we use as currency. A few months ago, I argued that one of the reasons that gold and Bitcoin are good currencies is because they’re fairly useless for any other purpose. Because they can have no use-value, they can only have exchange-value, a defining principle of currency.

And finally, non-fungible tokens allow us to apply that insight—that we can value any non-essential items in our life for their exchange-value rather than use-value—back onto the things we collect. That is, they allow us to determine the worth of individual goods entirely for what we think someone else might eventually pay rather than what we think they’re worth to us. When we speak of the worth of a baseball card or a shoe, we are referring to the most that someone might pay for it, as long as we use it as little as possible. In the analog world, utility has traditionally been a liability for NFTs—a sign, if one were needed, that utility has no role in valuation.

In other words, NFTs let us treat the smallest differentiation between items in the world around us as meaningful signs of their valuation. The world and our place within it become comprehensible as a series of miraculous statistics; NFTs let us live in a world of pure investment.

A World of Money

To be clear, it would be a mistake to say that the matrix above represents some kind of history of economics in successive stages, though it likely parallels our own growth from children to adults. There’s no evidence that barter economies preceded currency economies, and each of these models exist in our lives simultaneously while often overlapping. Is a bronze knife an object for barter or a currency? Is a share of stock more akin to a fungible token like a currency or an NFT? There is only a spectrum of difference between categories, and the boundaries of each are hazy.

Still, we can draw some rough generalizations. Broadly speaking, the tokens of the top half lie in fictional worlds of our own invention while the non-tokens in the bottom half lie in physical reality. Fungible items on the left, meanwhile, correspond to mass-manufactured tools that can be infinitely reproduced whereas non-fungible items on the right in some way relate to advanced living organisms that are unique genetically.

And those generalizations give us our two major clues about the use-value of NFTs.

First, as we’ve seen, NFTs should fundamentally represent properties unique to us as living creatures: our phenotypes, our microscopic behaviors, our psychology, our place in time and space. So for example, NFTs might simulate individual animals as we saw above, but just as significantly, they could also be reflections of individual taste, location, availability, or any of the many other variables that individualize each of us. Analog NFTs like sneakers, art, and even apartments all fit this criteria perfectly.

With that said, not every unique relationship or service online need be an NFT either. For example, if we want a better way to record the individual payments that billionaires make to lobbyists, or a way to record the proportion of code each developer contributed to an open-source project, we don’t need NFTs to track these. Instead, we might treat each dollar that’s donated or each line of code that’s written as a fungible token, worth a certain amount. Fungible tokens, after all, are traded between unique wallet addresses in unique transactions, so a ledger will already record these unique contributions. NFTs, in other words, are not helpful for representing the relationship between individuals, but rather the properties of individuals in and of themselves.

So we can simplify even further to say that a given NFT should reflect at least one of four properties unique to us as individuals: our physiognomy, our personality, our position in space, or our position in time.

Second, lying in the top half of our matrix, NFTs turn objects—particularly objects for which there can be little consensus of value—into money. NFTs, in other words, are really currency in disguise: as we’ve seen, they are typically collected and traded as speculative financial investments. That effectively means that the difference between NFTs and toys is one of intent, rather than function. When parents buy Beanie Babies for their children to enjoy as objects, they’re purchasing fairly fungible non-tokens, but when they buy them as an investment, they’re purchasing non-fungible (or limited edition) tokens whose value is worth whatever the market says they’re worth.

The bigger point, then, is not that digital goods are all NFTs—but that NFTs enable the financialization of all digital goods and services. Online goods, after all, are both non-essential, meaning that we have little reason to value them for their use-value rather than exchange-value, and easily transacted and traded, increasingly so with crypto. Above all, the legibility of virtual goods and services as money is what enables them to be traded and treated primarily as financial speculations. Whether we like it or not, NFTs portend a future in which everything becomes an investment.

So one working framework for the utility of NFTs is this: they’re a way to treat objects with lifeform-like properties as investments.

What that might mean in terms of auctioning off our time, our spaces, our concert tickets, our parking permits, and our membership cards—well, that awaits to be seen in Part Two.

***

A final note: this piece on the properties and purposes of NFTs would not exist without the incredible editorial work of Lila Shroff. Lila and I originally envisioned writing out some practical use-cases for NFTs, but as she continued to push—and push back against—my superficial framework, I was forced to revise, extend, and ultimately rethink my thoughts. There’s no more valuable intellectual exercise than that, and I’m extremely grateful to her for the generous time and brilliant thought she’s expended on this piece.

–

This article originally appeared on Three quarks – deep dives into crypto and web3: what does the past of tech, culture, and economics tell us about their future?

Comments

Michael Law@michaellaww

@uno online Can you explain the difference between fungible and non-fungible tokens?

Share

More stories

Mathew Hardy · How To · 3 min read

How to Detect AI Content with Keystroke Tracking

Sanjana Friedman · Opinions · 9 min read

The Case for Supabase

Vaibhav Gupta · Opinions · 10 min read

3.5 Years, 12 Hard Pivots, Still Not Dead

Kyle Corbitt · How To · 5 min read

A Founder’s Guide to AI Fine-Tuning

Chris Bakke · How To · 6 min read

A Better Way to Get Your First 10 B2B Customers