Secfi

Equity planning, stock option financing, and wealth management for startup employees.

•27 reviews•250 followers

What is Secfi?

Get equity planning, stock option financing, and wealth management from advisors that know how stock options and equity can help grow your wealth.

Do you use Secfi?

Recent Secfi Launches

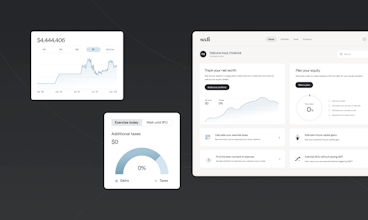

Secfi Portfolio A portfolio tracker that doesn’t ignore your private equity

Launched on November 15th, 2023

Equity Planner Create and compare personalized plans for your stock options

Launched on January 25th, 2023

Options Exercise Tax Calculator v2 See how much money you need to exercise your startup options

Launched on September 9th, 2020

Forum Threads

Secfi Portfolio - A portfolio tracker that doesn’t ignore your private equity

Secfi’s Portfolio is the all-in-one equity tracker, seamlessly integrating with Carta and Plaid. Gain clear insights into your private equity's value using funding rounds data, while keeping an eye on your holistic portfolio.

Equity Planner - Create and compare personalized plans for your stock options

Add your stock options, choose the plans that you want to compare and see a personalized breakdown of the tax implications and potential net gains. There are plans for early exercising, what an IPO could look like, potential outcome of a secondary sale & more!

Options Exercise Financing By Secfi - Exercise your startup options without the risk

Secfi helps start-up employees make the most of their equity situation. Our exercise financing helps minimize personal risk and covers exercise costs and taxes. Participate in your company's success, while keeping your savings to achieve your life goals.

Secfi Alternatives

View all Secfi alternativesReview Secfi?

3.88/5 based on 27 reviews

Reviews

•4 reviews

Secfi provides what would otherwise be a helpful service to employees at venture-backed startups: financing of options for exercise.

For employees who want to derisk or don't have the capital, it's a decent option. The problem enters with their terms.

First, you are paying an automated fee every month for basically nothing directly to Secfi. They say it's for their platform and trust management but they literally have to do nothing to earn the fee each month.

Second, the terms of any agreement you get through them are egregious. Not only does the financier share in the upside but they charge a ridiculously high interest fee which compounds. This means you should only receive financing if:

1. There's an IMMINENT exit (< 6 months)

2. The exit is for a very high multiple of what you purchased the shares for.

Otherwise, the interest will eat into your cost basis, leaving you with basically nothing.

This is essentially a lender of last resort and should be treated as such despite their friendly public marketing.

They get to offer predatory terms because there are few financiers operating in this market. It's completely exploitative.

•2 reviews

Very solid and knowledgeable team that helps with every single step of the process and answers any questions. The tools are helpful to see what different outcomes for your company would mean for your equity (eg in case of and exit at a certain valuation).